LHDN to Launch Mandatory E-Invoice Policy Starting in 2024!

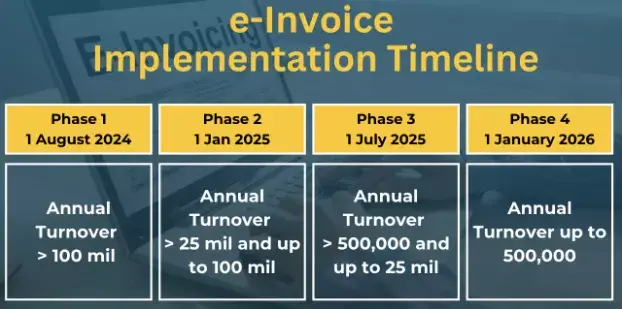

The Lembaga Hasil Dalam Negeri Malaysia (LHDN) has announced that e-invoicing will become mandatory in phases starting August 2024. Companies with an annual turnover exceeding RM100 million will be the first group required to implement this system.

The main objective of e-invoice implementation is to enhance operational efficiency and minimize tax leakage. To ensure a successful rollout, the government has reviewed e-invoice practices in other countries and is adopting a phased approach.

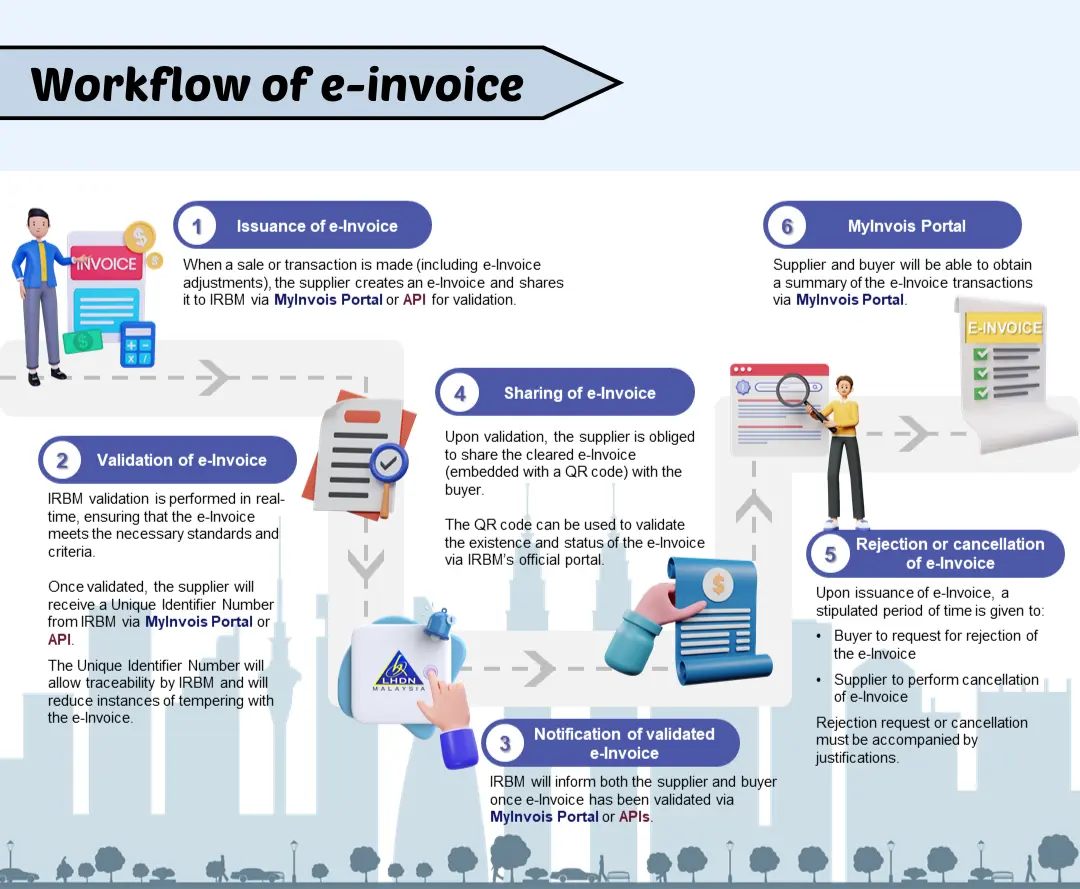

Overview for E-invoice workflow

- Issuance of e-invoice

- Validation of e-invoice

- Notification of validated e-invoice

- Sharing of e-invoice

- Rejection or cancellation of e-invoice

- Check e-invoice via MyInvois Portal

Note: E-invoicing is compulsory for all companies as per their respective implementation phases. Currently, e-invoicing applies only to B2B transactions. B2C implementation will follow once B2B is running smoothly.

What is E-invoice

An E-invoice is a digital method of documenting every business transaction. With full implementation, physical receipts will no longer be necessary, as all transaction data will be securely backed up in LHDN’s central database. When it’s time to file annual tax returns, eligible expenses will be automatically matched in the system, removing the need for taxpayers to manually input them.

Who needs to follow e-Invoicing rules in Malaysia?

All individuals and legal entities are required to comply with the e-Invoicing requirement, including:

- Associations;

- Body of persons;

- Branches;

- Business trusts;

- Co-operative societies;

- Corporations;

- Limited liability partnerships;

- Partnerships;

- Property trust funds;

- Property trusts;

- Real estate investment trusts;

- Representative offices and regional offices;

- Trust bodies; and

- Unit trusts.

E-invoice Guidelines