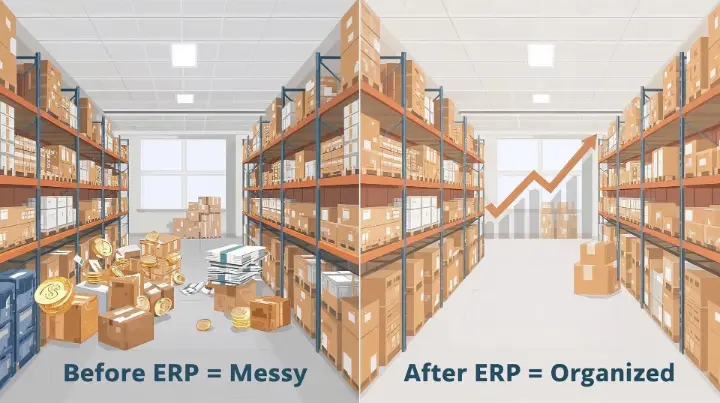

Many small and medium enterprises (SMEs) hesitate to adopt ERP systems because they believe these solutions are expensive or only suitable for large corporations. In reality, the right ERP system can help SMEs save money, cut unnecessary costs, and strengthen long-term profitability.

Modern ERP solutions—especially affordable, cloud-based options—are now accessible to smaller businesses and can deliver significant financial value. Here are some of the main financial benefits SMEs can expect:

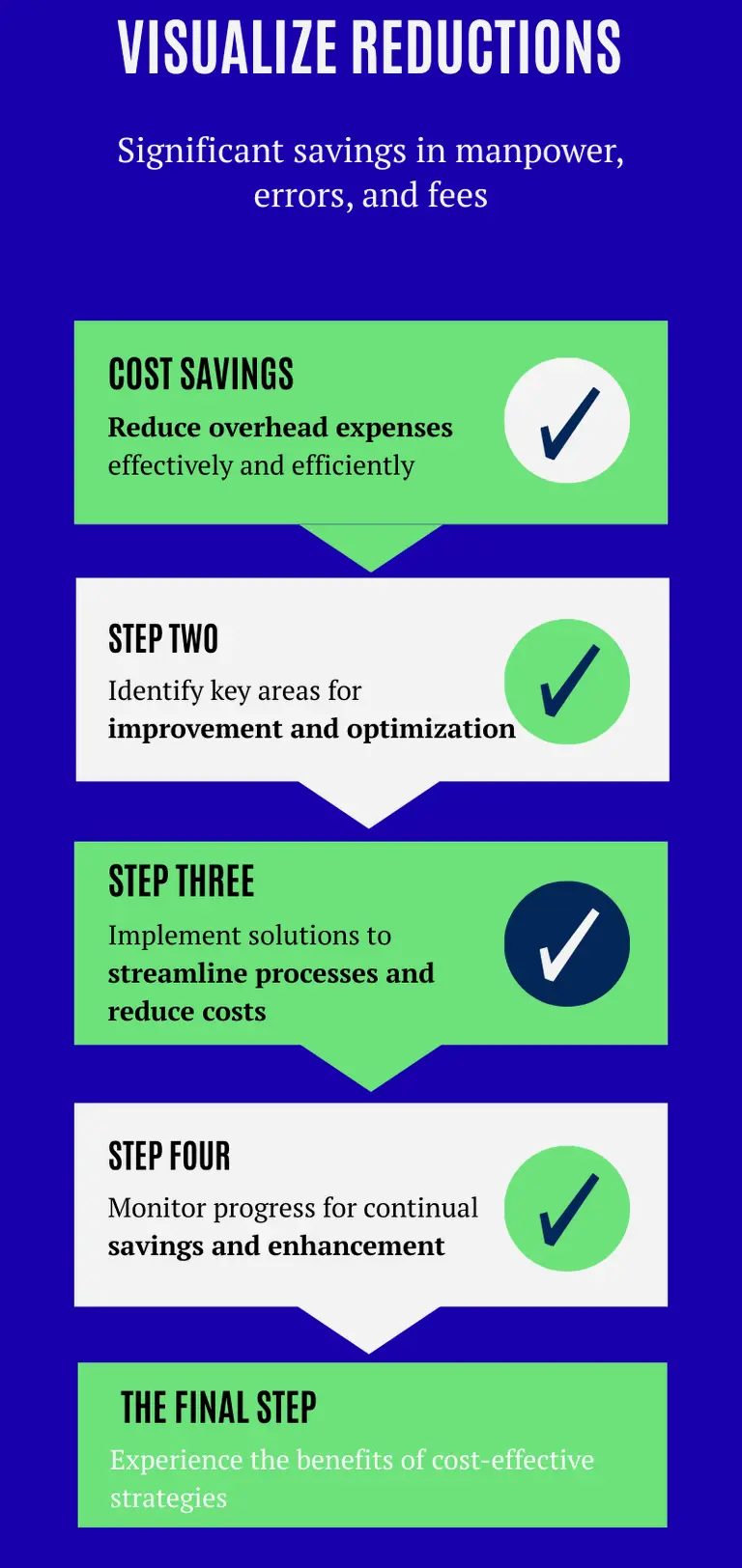

Immediate Cost

Reductions

When ERP centralises daily operations, cost savings show up quickly. Here’s how:

- ❌ Fewer clerical hours spent on manual data entry.

- ❌ Less duplication between finance, sales, and inventory records.

- ✅ Lower error correction costs (no more wrong invoices or mismatched stock).

- ✅ Savings on outsourced bookkeeping or compliance tasks.

These savings alone often cover the ERP subscription fee within the first year.

Cash Flow Timeline: How ERP Pays Off Over Time

Think of ERP as an investment that matures with your business. Here’s a typical financial impact timeline we’ve observed in Malaysian SMEs:

Month 1–3:

- Faster invoicing speeds up customer payments.

- Visibility into outstanding bills prevents missed collections.

Month 4–6:

- Reduced reliance on short-term loans or overdrafts.

- Improved supplier negotiations (because you know your cash position clearly).

Month 7–12:

- Predictable cash cycles enable expansion planning.

- More working capital available to reinvest in marketing, staff, or new products.

Inventory: Turning Stock Into Profits

For SMEs in retail, trading, or manufacturing, inventory is often the second-largest cost area after salaries. Mismanagement locks up cash in slow-moving goods, leads to overstocking, or forces last-minute purchases at inflated prices.

How Conzlab ERP strengthens financial control in inventory:

- Optimized purchase planning – the system uses sales history and demand patterns to recommend purchase quantities, reducing excess stock and freeing up cash.

- Real-time visibility – owners know exactly what’s available, where it’s stored, and how quickly it moves. This prevents over-purchasing and ensures stock accuracy.

- Reduced hidden costs – smarter stock rotation lowers wastage, while fewer “emergency” orders reduce logistics and supplier premium charges.

- Capital efficiency – SMEs can always see the financial value of their stock, helping decide whether cash should go into replenishment, marketing, or expansion.

💡 Financial benefit: Instead of money being trapped in unsold items, liquidity improves—strengthening the balance sheet and creating room for growth.

Compliance Without Extra Spending

Compliance in Malaysia is non-negotiable: SMEs must manage EPF, SOCSO, EIS, HRDF, SST, corporate tax, and soon, mandatory e-Invoicing from LHDN. Non-compliance risks fines, penalties, and reputational damage.

How Conzlab ERP reduces compliance-related costs:

- Automated payroll compliance – monthly statutory contributions are calculated accurately, reducing errors and avoiding late-payment penalties.

- E-invoicing readiness – invoices generated match LHDN’s format, removing manual rework or rejection risk.

- Audit-ready financial reports – consolidated records are available on demand, saving time during audits and cutting outsourcing fees.

- Error prevention – duplicate or inconsistent data is flagged before submission, reducing costly mistakes that lead to fines.

The Financial Benefits of Implementing ERP in SMEs